Different Approaches to Systematic Credit Factor Investing. A white paper by Andrea Dacquin, Head of Fixed Income, Quoniam Asset Management.

Systematic investing offers a number of advantages, not only in equity but also in corporate bond markets. Two approaches to systematic credit investing are important to review: a mix of single factors and a multi-factor fair value approach.

When it comes to disciplined investing and controlling risk the use of systematic approaches in active asset management offers a number of advantages: Firstly, it removes the element of subjectivity inherent in human analysis and thus immunizes investment decisions from cognitive biases. Secondly, it allows to deal with investment universes of several thousands of securities in an efficient, timely and uniform manner which is particularly important for the vast and increasing bond universes. Global investment grade and global high yield universes have more than doubled in the last two decades counting more than 11.500 securities today. Thirdly, security selection using a systematic factor approach is fully explainable and traceable back to the criterion used at any time in the past and provides a high degree of transparency.

Factors and the fixed income universe

Fixed income investors naturally position themselves around duration, term structure, credit spread, and liquidity which makes fixed income a natural place to apply systematic, factor based investing. Corporate bond pricing is not independent from equity pricing but it is important to keep in mind that there are critical differences between equity and corporate bond markets.

Firstly, unique market dynamics related to changes in fixed income curves and carry for return generation as well as liquidity properties of bond portfolios need to be taken into account. Transaction costs are higher, liquidity is poorer and it is very hard to take short positions in most corporate bonds. Secondly, the factors need to be tailored to the corporate bond market. For example, while book-to-price as a measure of “value” in equity factor investing exhibits a well-known positive relation with future equity returns, it is less significant for value assessment in fixed income. Thirdly, credit as an asset class is very fragmented with substantially different risk-return profiles. High grade credit and high yield bonds, financials and non-financials, seniors and subordinates – there is no ‘one-fits-all’ factor composition for all those different segments.

The academic evidence for factor investing in fixed income is long and various. Starting with the original Fama/French papers, there is a rich academic evidence of systematic sources – other than rates, spread and inflation curves – that can explain variation in fixed income returns. Bearing in mind the importance of steady income generation and limited risk budgets imposed by the current challenging regulatory environment there are two different approaches to systematic credit investing in Euro corporate high grade that are important to review: A mix of single factors and a multi-factor fair value approach.

Mix of single factors

To illustrate the two approaches, based on our empirical analysis, we start with the construction of the ‘mix of single factors’ portfolio by focusing on the selection of credit factors delivering the best risk-reward profile for the Euro high grade corporate bond universe. Out of our universe of more than 20 composite factors that we follow regularly we have identified three that are providing the most suitable results for above stated investment universe – quality, bond momentum and sentiment.

The quality factor reflects the quality of company growth and is the factor characteristic of securities that are good stores of value during periods of market sell-offs. The quality factor outperformed other single factors during the financial crisis in 2008 as well as amid the European sovereign debt turmoil. The flipside of the coin is the underperformance of quality during periods of strong market rallies. The quality factor tilts portfolio construction towards issuers with high quality of growth and consequently demonstrates excess return associated with holding high quality, low-beta bonds. The quality factor portfolio generated lowest outperformance which is not surprising given its low Beta characteristics in the market environment where credit spreads have tightened on average. Notwithstanding its low return contribution the factor is a very good diversifier for traditional benchmark management.

1 Quality is a composite factor consisting of financial ratios like change in ROA, change in asset turnover, R&D costs to Total Assets, and other balance sheet items relevant for assessment of growth quality.

The bond momentum factor portfolio allocates to bonds that have outperformed over the last twelve months with one month implementation lag and tilts portfolio construction towards past winners. We scale the factor loading by volatility for the sake of exposure reduction to high Beta bonds during periods of market sell-offs. Even if volatility scaling has mitigated downside to a certain extent, it is not surprising that out of the three factors – quality, bond momentum and sentiment – that are providing the most suitable results (with Sharpe Ratios well above the benchmark ) bond momentum has only generated the second strongest Sharpe Ratio. It shows how important it is for fixed income investors to understand the role of fat tails and asymmetry in bond return distributions. The price appreciation in bonds is limited as prices remain relatively close to par but the downside risk is substantial. We focus on downside risk mitigation which is reflected in our use of a risk-adjusted momentum factor.

The sentiment factor is a sophisticated composite equity momentum factor reflecting risk-adjusted aggregation of single stock, industry, geographic region and customer supply momentums. The sentiment factor portfolio allocates to bonds whose equity counterparts were the winners across the categories described above over the past twelve months with one month implementation lag. The sentiment factor portfolio outperformed the bond momentum factor portfolio both in terms of capital appreciation and risk-adjusted outperformance relative to the market cap-weighted index.

The security selection follows a so-called best-in-class methodology, which consists in ranking bonds with respect to factor exposure and select best. In the factor portfolio construction process we allocate to all issuers that are at least one standard deviation away from the studentized mean of the factor. Once the three factor portfolios are built, the ‘mix of single factors’ portfolio allocates equally to each factor portfolio. The rebalancing occurs monthly and the framework controls for duration and curve exposure. We have not included a single value factor in this ‘mix of single factors’ portfolio – we believe that credit value needs to incorporate some definition of relative value and this is not directly feasible in the factor framework. For this reason, a multi factor fair value approach is essential.

Multi-factor fair value model

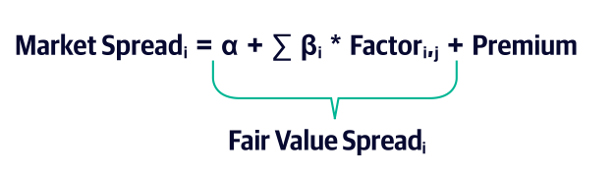

To construct a multi-factor fair value portfolio we firstly run a cross-sectional regression of issuer market spread on multiple factors like equity implied volatility , profitability, leverage, solvency, size, changes in earnings, changes in analyst recommendations and other factors. All factors are fundamentally meaningful, statistically robust and stable over time in explaining issuer credit spread. The sum of the factors calibrated with their respective slope coefficients estimated in cross-sectional regression represents the fair value spread. The premium in the equation below makes the issuer spread quoted in the market equal the fair value spread:

The premium itself represents market mis-pricing allowing to identify cheap and rich bonds. The ranking of bonds is then established with respect to the premium, and the best 10% of bonds with the highest positive premiums are selected each month. Re-balancing and return calculation follows the methodology outlined before.

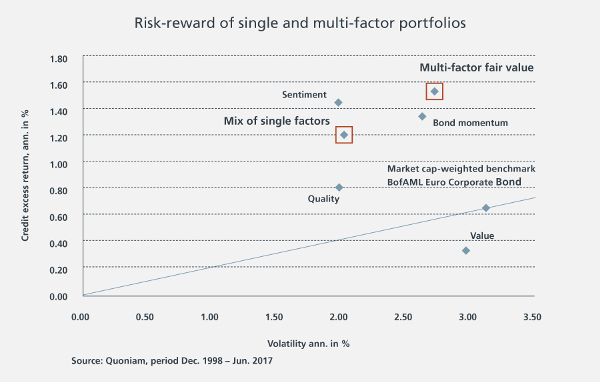

But instead of using a rather simplistic equal allocation to factors – as in the case of the ‘mix of single factors’ portfolio – within the multi-factor fair value framework the allocation to factors reflects the long-term systematic relationship between the factor and the market spread – and the allocation to factors over time considers changes in factor relevance for explanation of returns. The chart shows the risk-reward of single and multi-factor portfolios since December 1998 in a scatter diagram.

2 Market cap-weighted benchmark BofAML Euro Corporate Bond

3 We exploit findings of the Merton Model (1974) in the factor composition of our fair value approach.

Multi-factor fair value approach shows best capital appreciation

All factor portfolios – with the exception of value – outperformed the market cap-weighted benchmark and earned significantly higher Sharpe Ratios. The ‘mix of single factors’ portfolio shows an outperformance of 0.54% points above the market index credit excess return of 0.66% points and a low correlation to the market cap-weighted index. But the best outcome in terms of capital appreciation and risk-adjusted returns is being delivered by the multi-factor fair value strategy, showing an out-performance of 0.89% points. Due to high turnover associated with sentiment and momentum single-factor strategies the multi-factor fair value strategy shows by far the most attractive Information Ratio after transaction costs. Looking at the risk-reward superiority of credit factor strategies, and especially sophisticated factor composition, it is very likely that factor investing will change the landscape of fixed income investing, which is still very much dominated by investment based upon fundamentals. As more players engage in credit factor investing, we believe that factor definitions and their risks and rewards must be continuously reviewed to assure that they are appropriately used.

This whitepaper by Quoniam Asset Management is part of the Fixed Income Investment Strategies, Europe 2017 report. Download your free copy of the full report here.

DISCLAIMER